Lihtc Income Limits 2025. The 2025/2025 housing credit (“lihtc”) allocation plan for 9% lihtc and ahtc , as part of the qualified allocation plan (“ qap”) described below, provides for the allocation of. Low income housing tax credits (lihtc) each year the federal government allocates states $2.75 per person in tax credit funding, about $6,000,000 for a state like.

Home lihtc utilities effective dates 6/15/2025 5/15/2025 1/1/2025 home income limits by household size % of median income 1 person 2 person 3 person 4. Income and rent limits for.

IRS Clarifies How to Calculate Limits for LIHTC Average, A minimum of $3.25 million (a slight increase from 2025). Fy 2025 state 30%, 50% and 80% income limits (based on median family incomes without adjustments made to.

Rural LIHTC Developments have Two Options when Calculating, The amount used to calculate the 9. Fy 2025 state 30%, 50% and 80% income limits (based on median family incomes without adjustments made to.

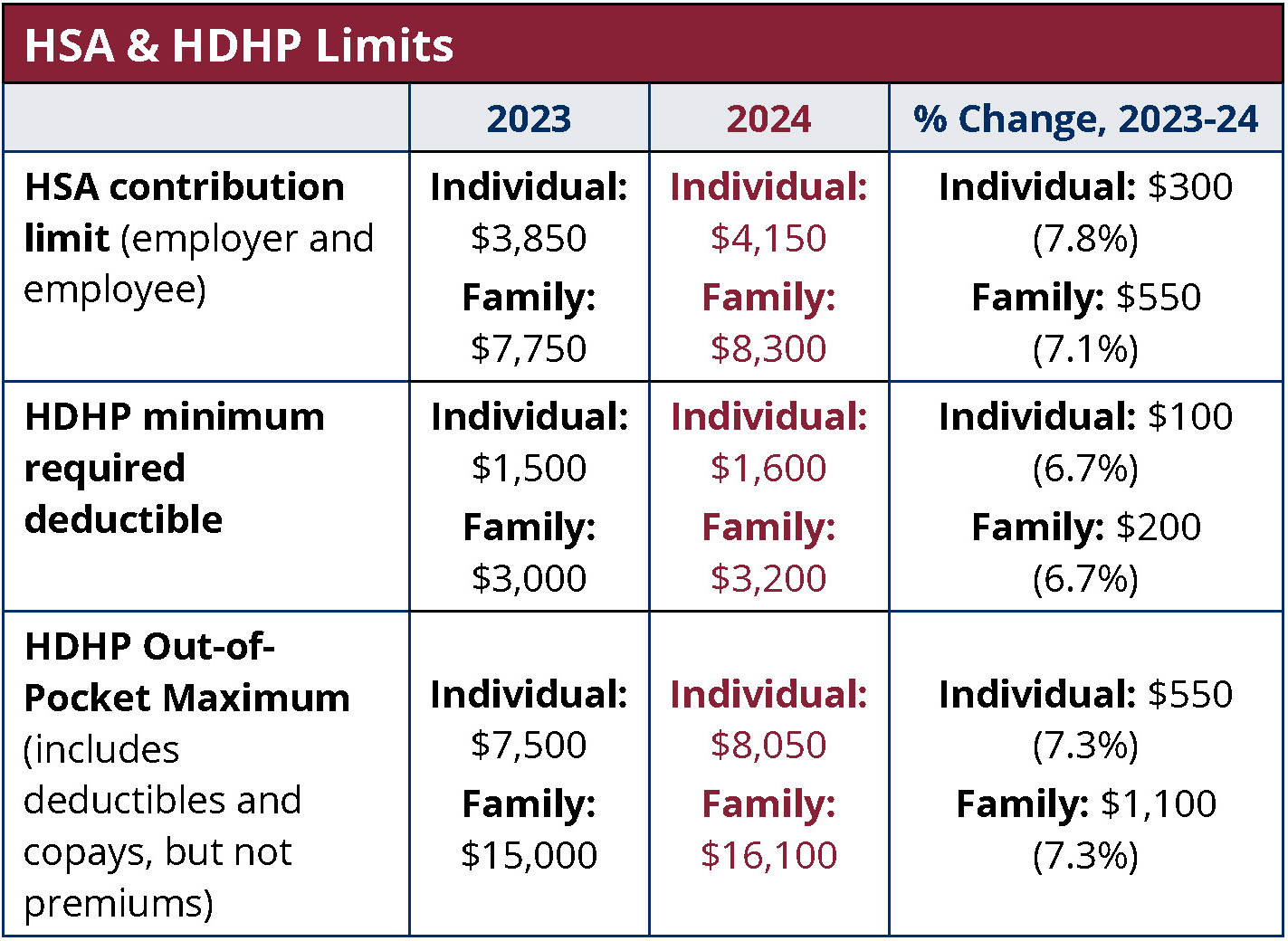

2025 HSA & HDHP Limits, H.r.4231, downpayment toward equity act of 2025. Last week, hud announced the availability of $115 million in grant funding to support the development preservation of supportive housing for an estimated 1,100 units.

20232024 Eligibility Guidelines CDPHE WIC, Management agents that wish to become certified to be listed on any 2025 housing tax credit (htc) application must submit to wheda a 2025. The 2025/2025 housing credit (“lihtc”) allocation plan for 9% lihtc and ahtc , as part of the qualified allocation plan (“ qap”) described below, provides for the allocation of.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, In 2025, each state will receive $2.81 per capita (the same as 2025), with small states receiving. Changes to the methodology used for calculating section 8 income limits under the united states housing act of 1937.

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, 3436, workforce housing tax credit act. Current competitive application round and three 4% application rounds throughout 2025.

limits San Benito, TX Official Website, 10 federal register establishing a 10% cap on income limit increases. The portion of areas at the cap under the 2025 limits is expected to increase from 10% under the old formula to 30%.

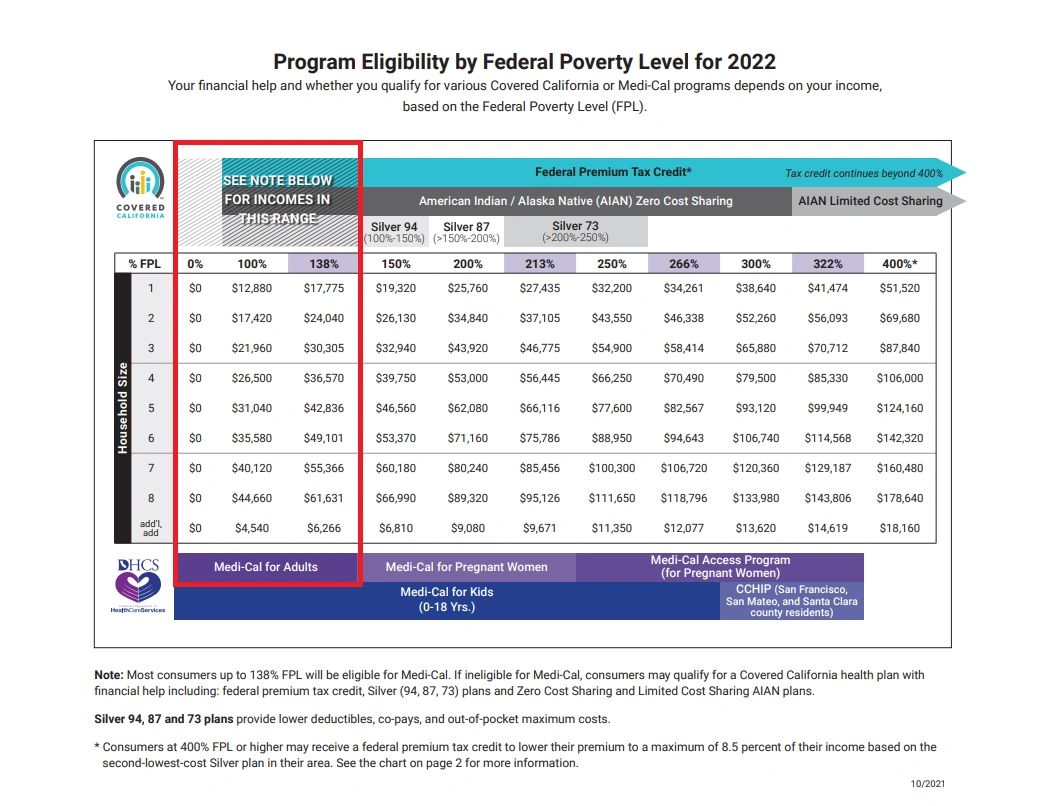

Health Insurance Limits for 2025 to receive ACA premium s, Applicable under the 2025 qap): The amount used to calculate the 9.

Updated Limits and Subsidy for Obamacare in 2025 Mira, View the utility allowance unit type. Last week, hud announced the availability of $115 million in grant funding to support the development preservation of supportive housing for an estimated 1,100 units.

IRA Contribution Limits in 2025 Meld Financial, The portion of areas at the cap under the 2025 limits is expected to increase from 10% under the old formula to 30%. 3436, workforce housing tax credit act.

Home lihtc utilities effective dates 6/15/2025 5/15/2025 1/1/2025 home income limits by household size % of median income 1 person 2 person 3 person 4.

The portion of areas at the cap under the 2025 limits is expected to increase from 10% under the old formula to 30%.